Credit restriction surcharge

In This Topic

Business value

Some businesses apply a credit restriction surcharge to certain parts of their customer base. This means that the invoice is increased by, for example, 2% (excluding VAT), expressed as a specific amount. If customers fail to pay within a designated period, they are required to pay the credit restriction fee. If the invoice is paid within the credit restriction period, the credit restriction may be deducted from the total amount.

Business assumptions

In order to work with the credit restriction surcharge, some assumptions apply:

- The credit restriction surcharge is automatically added as a surcharge to sales orders when entering sales orders.

- For free text invoicing to customers, the credit restriction surcharge is automatically added when the invoice is posted.

- Payment discount in the form of a credit restriction excluding VAT. This means that in addition to the goods amount, other surcharges such as freight must also be taken into account.

- It is not possible to use cash discount and credit restriction at the same time for the same customer. Only manually at the order level can you choose either cash discount or credit restriction.

- At the time of invoicing, the amount must be added and posted separately.

- The functionality does not take VAT into account for credit restriction surcharge. That should be invoiced separately, if applicable.

Solution direction

The philosophy of this functionality is based on a combination of "Automatic surcharges" and "Cash discounts". The automatic surcharge adds the credit restriction to the sales invoice. The cash discount subtracts the surcharge from the payment if the customer has paid on time and has not paid the surcharge. The default calculation method of the cash discounts in Microsoft Dynamics 365 for Finance and Operations is adjusted in order to deduct the correct amount of the credit restriction.

Setup requirements

- A charge code must be set up to arrange the posting of the credit restriction charge (Accounts receivable > Charges Setup > Charge codes). The Boolean ‘Credit restriction’ must be set to ‘Yes’.

- An auto charge must be set up (Accounts receivable > Charges Setup > Auto charges). This auto charge must include the charge code created at step 1. Assign a charge group to the auto charge.

- A designated cash discount must be set up in order to deduct the credit restriction charge if the sales order is paid on time (Accounts receivable > Payments Setup > Cash discounts). The Boolean ‘Credit restriction’ must be set to ‘Yes’.

- The charge group that is assigned to the auto charge in step 2 must be assigned to the applicable customers (Accounts receivable > Customers > All Customers > tab Payment defaults). If the customer is linked to this charge group, it must also be linked to the designated cash discount code, created in step 3.

Logic of the credit restriction surcharge

A sales order is created for a customer. Goods: EUR 100, surcharge for freight is EUR 10. The credit restriction is 2 %, if payment is made within 8 days, the customer can deduct the credit restriction from the amount to be paid.

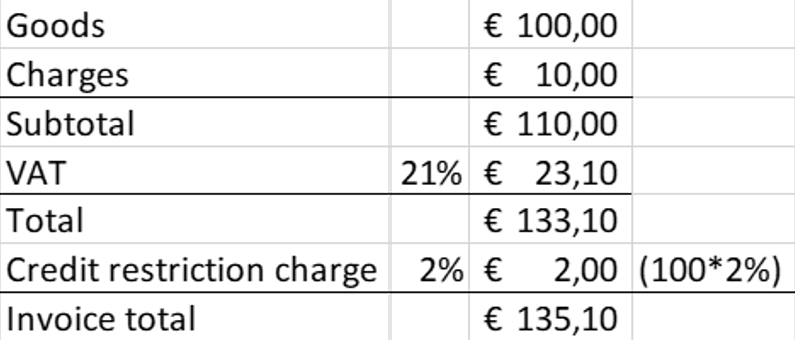

Standard Microsoft Dynamics 365 for Finance and Operations calculation method for these surcharges:

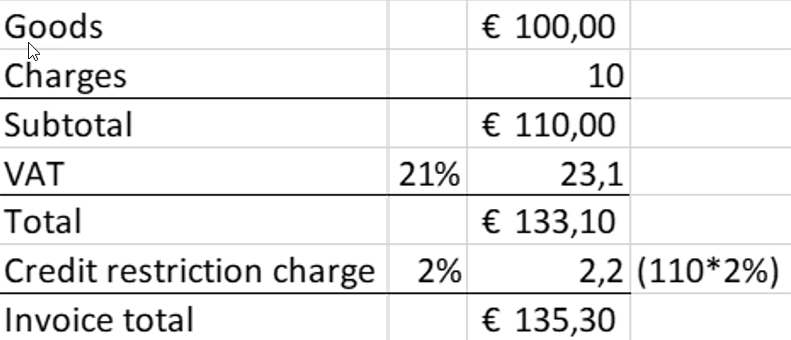

Credit restriction calculation method:

Based on the surcharge code, the 2.20 credit is posted on the main account for credit restriction turnover.

Note

Credit restriction is excluding VAT, but is calculated based on the price of the goods and additional surcharges.